The travel industry thrives on customer convenience and satisfaction. An integral part of that is ensuring that customers have a frictionless way to pay for services.

Integrating a robust payment system into your travel agency’s software can transform your operations, making transactions faster, more secure, and capable of accommodating diverse payment methods.

In the fast-paced world of travel, seamless and secure payment processes are critical for an exceptional customer experience. Integrating a payment system into your travel agency software ensures smooth transactions, enhances trust, and fosters customer loyalty.

This comprehensive guide will explore the benefits, challenges, and best practices for effectively integrating payment systems.

a. Improved Customer Experience

A streamlined payment process is fundamental to customer satisfaction. The ability to quickly complete a transaction means fewer cart abandonments and higher conversion rates. For instance, a study by the Baymard Institute found that nearly 18% of shoppers abandon their carts due to a long or complicated checkout process. A seamless integration reduces these friction points.

b. Enhanced Security and Compliance

Integrating a trusted payment system comes with built-in security protocols such as tokenization and encryption, which protect sensitive data. Compliance with global standards like PCI DSS (Payment Card Industry Data Security Standard) ensures that your agency operates within legal requirements, safeguarding both you and your customers.

c. Expanded Payment Options

Offering various payment methods, such as credit cards, e-wallets, bank transfers, and even cryptocurrencies, appeals to a global audience. This is especially important for travel agencies, as clients often come from different parts of the world with varying payment preferences.

Statistic: According to Worldpay’s Global Payments Report, over 40% of global online transactions are made via digital wallets.

a. Payment Gateways vs. Payment Processors

Understanding the difference between payment gateways and processors is crucial:

b. Examples of Popular Systems

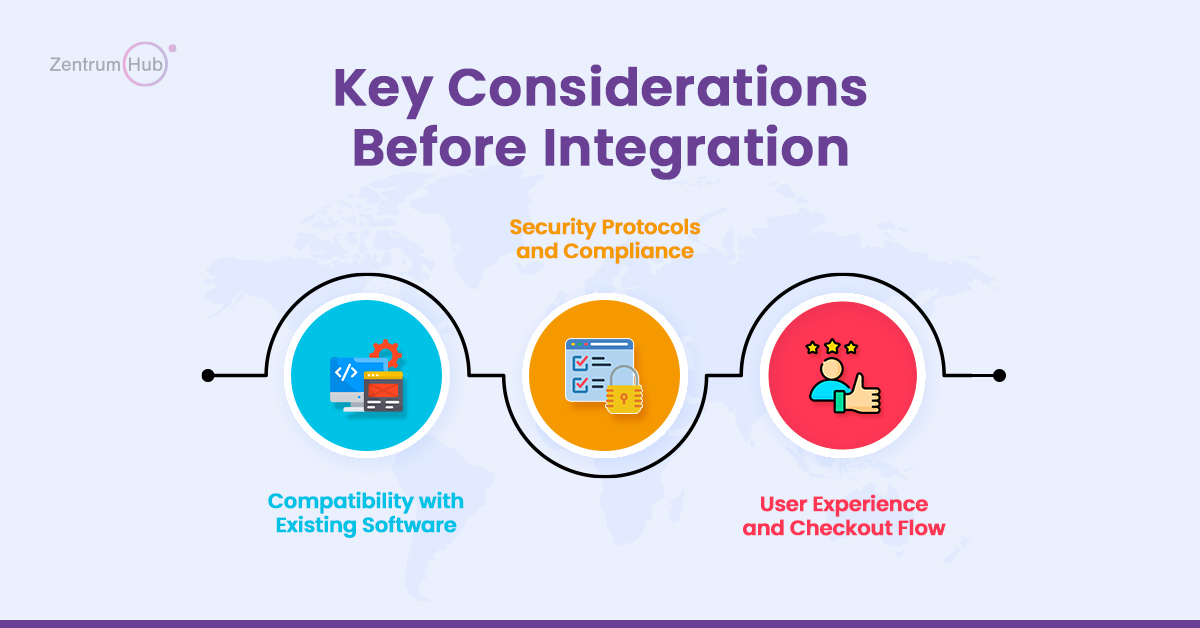

a. Compatibility with Existing Software

Evaluate the technical specifications of your current travel agency software. Most popular travel platforms support third-party integrations via APIs or plug-ins, but it’s essential to ensure your choice is compatible to avoid costly development time.

b. Security Protocols and Compliance

Choose a system that not only supports SSL certificates but also uses advanced authentication methods such as two-factor authentication (2FA) and tokenization. Compliance is non-negotiable for protecting user data.

c. User Experience and Checkout Flow

The payment process should be intuitive. A cluttered or overly complex interface can lead to abandoned bookings. Ensure minimal steps between selecting a service and completing the payment.

Best Practice: Conduct user testing to identify any bottlenecks in the checkout process. Tools like Hotjar can provide heatmaps and session recordings for optimization.

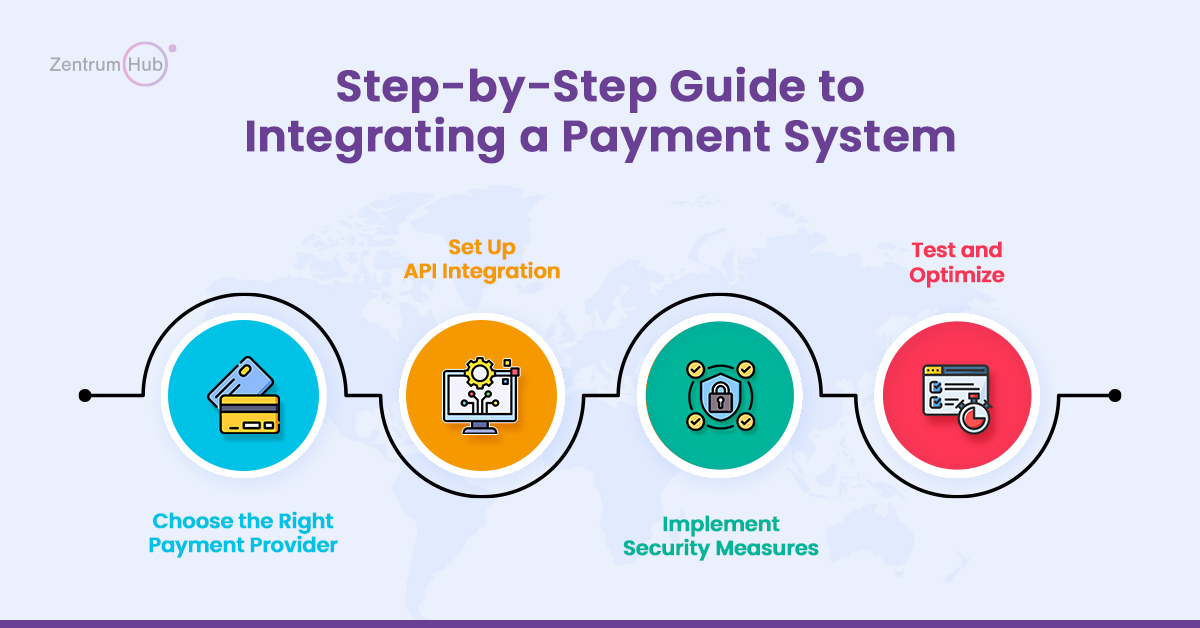

Step 1: Choose the Right Payment Provider

Your first step should be researching the providers that best align with your business needs. Consider factors such as transaction fees, customer support, global reach, and customization capabilities.

Checklist:

Step 2: Set Up API Integration

Once you’ve selected a provider, your development team will need to integrate the payment system’s API. This may involve coding and setting up webhooks for transaction statuses.

Pro Tip: Use sandbox environments provided by many payment providers to test the integration without real money transfers.

Step 3: Implement Security Measures

Security is paramount. Implement SSL/TLS certificates for data encryption and consider integrating 3D Secure for an extra layer of cardholder authentication.

Tip: Enable address verification services (AVS) to verify billing addresses for added fraud protection.

Step 4: Test and Optimize

Run comprehensive tests for all types of transactions, including successful payments, declined cards, refunds, and partial payments. Testing helps identify any potential issues before going live.

Checklist for Testing:

a. Technical Issues

Integrating a payment system may lead to unexpected bugs or compatibility issues. Collaborating with experienced developers who understand both your travel software and the payment system can alleviate these technical difficulties.

Solution: Work with payment providers that offer strong developer support, including detailed documentation and responsive technical teams.

b. Regulatory Challenges

Navigating regulations like PCI DSS and PSD2 (for European transactions) can be daunting. Partnering with a payment provider familiar with these regulations can help you stay compliant.

Advice: Periodically audit your payment systems and consult legal experts to ensure ongoing compliance.

a. Regular Updates and Maintenance

The digital payment landscape changes rapidly. Regularly update your software and payment system to patch vulnerabilities and add new features.

Tip: Schedule periodic reviews of your payment process to assess whether it aligns with the latest security standards and customer expectations.

b. Transparent Policies

Display clear payment policies, including refunds and cancellations. Transparency reduces disputes and chargebacks, contributing to smoother operations.

Example: Use straightforward language and bullet points for policies on your payment and booking pages to enhance customer understanding.

Integrating a payment system into your travel agency software is essential for staying competitive.

By choosing the right provider, securing data, and maintaining an optimal user experience, you can build a robust, customer-friendly payment process. Keep compliance at the forefront and update your system regularly to adapt to industry changes.

A thoughtful integration approach not only simplifies payment processes but also enhances customer trust and satisfaction.

Implement these strategies to maximize the potential of your travel business and ensure a secure, user-friendly experience for all clients.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.